Incorporation Limited and Company: Since the earliest moments in human history, they have been trading to create wealth and gain access to goods and services in various markets.

For example

Exchanging items like wheat or corn for stone tools or meat for the skin to wear.

Soon with the time humanity grows, various industrial revolutions occurred in different parts of the world.

And with this, all kind of scientific discoveries and technological advancement emerged.

As the businesses grow, it becomes riskier and requires high investment as well as high return proposition.

What used to exist in past has now become extraneous and more complicated.

And to handle this complexity, the concept of Inc (Incorporation), Ltd (limited) and company (Co.) emerged.

Originally

There are three types of companies in the world

1. Proprietor firm

2. Corporation

3. Partnership

1. Proprietor firm: It is a kind of ownership in which a single person owns a firm. Sole profit but also liability is unlimited. This means if something goes wrong, the owner will pay from his pocket

2. Corporation: In Corporation instead of single ownership shareholders invest infirm and owns the firm. Profit or loss will be shared among shareholders as per their investment in owning shares in the firm and liability is limited as it doesn’t have single owner, so the liability of paying back completely depends upon the firm and not on the director of the firm.

3. Partnership: In partnership group of people comes together and opens a firm to conduct business. Profit or loss is shared as per the percentage decided among the partners. Also, liability in partnership increases as a firm is owned by a group of people. And their liability also depends upon the percentage of investment.

Let’s try to understand this from a landmark judgment of UK court in 1896

Solomon vs Solomon & Co. Ltd

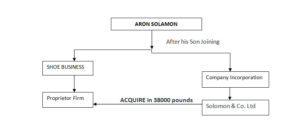

Aron Solomon was bootmaker in the UK owns firm but later his elder son showed interest in joining his business so what Aron Solomon does?

he incorporated another firm with the name Solomon & Co. Ltd

After incorporation, he acquired his own firm with 38000 pounds investment and made his family members its shareholders.

And kept 20,000 shares for himself, majority

Also, become director of the firm along with his son.

Moreover,

He also invested 10,000 Pounds in his company through debentures

which made him secure investor

Later after the 1-year company faced loss and become bankrupt.

Now the rule says, if companies fall first it will pay back its secure investor and then unsecured investors if some money left but here unsecured investors protested because of the ownership issues. And demanded not to pay Aron Solomon

And when the case went to court, judgment came in favour of Solomon that

COMPANY IS A SEPARATE LEGAL ENTITY

Solomon will not pay from his pocket and money will be recovered by selling it

This saved Solomon investment and liability.

So unsecured investors got nothing and Solomon being secure investor got his money back

Soon this concept spread all over the world

Nowadays many companies have established but their working is the same as it was in 1896

so

The difference between Inc. & Ltd. & Co. is

Inc. (Incorporation) means establishing firm having investment through stock or by members or partnership

Ltd (Limited) means reduces liability in matters of lawsuits and saves one’s own personal assets

Co. (company) means a group of people working together in a commercial or industrial firm.

And

LLC. (Limited Liability Companies) is a mixture of both corporation and partnership. In this type of firm, owners are protected from liability but bear both losses and profit from his personal assets. And hast to mention in his/her income taxes about profit or loss.