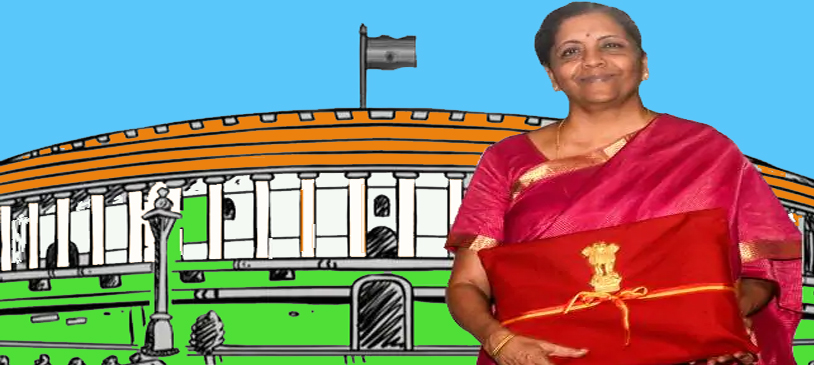

BUDGET 2019, Honorable Finance Minister Nirmala Sitharaman presented newly formed government budget for the year 2019 – 20 on Friday 7th July 2019.

Breaking the tradition of taking leather briefcase minister chooses red pouch for the event.

On which Chief Economic Advisor KV Subramanian said,

“It is in Indian tradition. symbolizes our departure from the slavery of Western thought. And this is not a budget but a ‘bahi khata'(ledger).”

Sitharaman, on her introductory speech, mentioned the government’s prime focus, which is “National Security” and “Economic Development”.

From my point of view, this time the government has not eulogized luring schemes and had completely focused on to boost investment at a time when the economy is slowing down and also the world economy is struggling.

Focusing on budget highlights

1. Nirmala Sitharaman, this time has not provided any change in income tax rate but has put on heavy taxes on super-rich class.

Those who have an income of 2 crores will now on pay 3% additional tax

And for those who have income more than 5 crores will pay 7% surcharge.

2. Corporate tax has been brought down by 5% for the companies which have a turnover of up to Rs 400 Crore.

At present, it was 30% but from now own it will be 25%.

This step has taken to boost MSME (Micro Small and Medium Enterprises) business capacity and providing them with enough space to explore more.

3. For those who don’t have PAN card from now on can use AADHAR CARD for ITR.

4. Seeing the menace of air pollution government is taking various steps to reduce it. And for that in the budget government has reduced GST on Electric vehicles from 12% to 5%.

5. The tax has been raised on tiles, cashew kernels, vinyl flooring, auto parts, some synthetic rubber, digital and video recorder and CCTV camera.

6. Housing for all and Pradhan Mantri Awas Yojana are the initiatives of the previous tenure of this government. Taking it forward from in its first budget government has shown its willingness. Rental law reformation and Additional Rs 1.5 lakh tax relief on home loan if one will purchase a house of 45 Lakh is one of the key highlights of this budget.

7. For NRI’s ease of living in India government has proposed Aadhar on arrival system.

8. Pension for informal sector workers which is Rs 3000 per month.

9. To boost digital payments which are also Modi 1.0 pan initiative, MDR ( merchant discount rate) which used to levi on for using POS (point of sale) machine government has removed it.

10. Being the First lady appointed as finance minister of India, it was expected that she will announce a special scheme for women empowerment. And she does, Nari tu Narayani she mentioned women SHG (Self Help Group) Interest Subvention Program will be promulgated to all the districts of India.

Also,

Rs 1 lakh loan to be provided for SHG women members under Mudra Scheme and the overdraft facility of Rs 5000 account under Jan Dhan Scheme.

11. In the Space sector, New Space India Limited (NSIL) company has decided to open to help and control benefits of ISRO. Mainly task is to more commercialize India space achievements.

12. 3.3% of the GDP is the fiscal deficit for the year 2019.

13. For Railways government has allocated Rs 65,837 Crore. Dedicated freight corridor to be completed by 2022.